[9]Beyond Automation: How AI Is Reshaping SaaS; A Case for Procure-to-Pay Workflow

GenAI is set to dissrupt enterprise software, transforming traditional systems of workflows to goal-oriented systems of work.

How AI Is Reshaping SaaS?

GenAI implementation is increasing in almost all the organizations but incumbents are shipping safe, increamental features (chatbots, benchmarks, descriptions) while startups are reimagining the entire workflows from AI first lense.

GenAI is transforming traditional workflow systems into dynamic, goal-oriented environments from Systems of Workflows to Systems of Work.

Most enterprise platforms like, SAP, Salesforce, Workday treat organizations as systems of workflows. Workflows are processes that enable the organization to accomplish any task. For example - Consider SAP ERP. Its data architecture is centered around standard objects such as materials, vendors, customers, and cost centers which form the backbone of enterprise-wide processes. This enables core functions like procurement, inventory management, financial accounting, and production planning to operate in a coordinated and auditable manner.

Completing a task like “create a purchase order” or “post an invoice” involves multiple interconnected modules such as MM (Materials Management), FI (Financial Accounting), and CO (Controlling) with each step tightly governed by business rules, approval hierarchies, and system validations.

By contrast, a system of work powered by GenAI - treats organizations as goal oriented task environments. Rather than beginning with a detailed map of every step in every workflow, it starts with the job to be done. GenAI systems generate necessary database queries and serve answers to users in seconds. Instead of operating in the pre-defined steps GenAI workflows look much smaller, more intelligent working under the hood working on wide range of structured and unstuctured data.

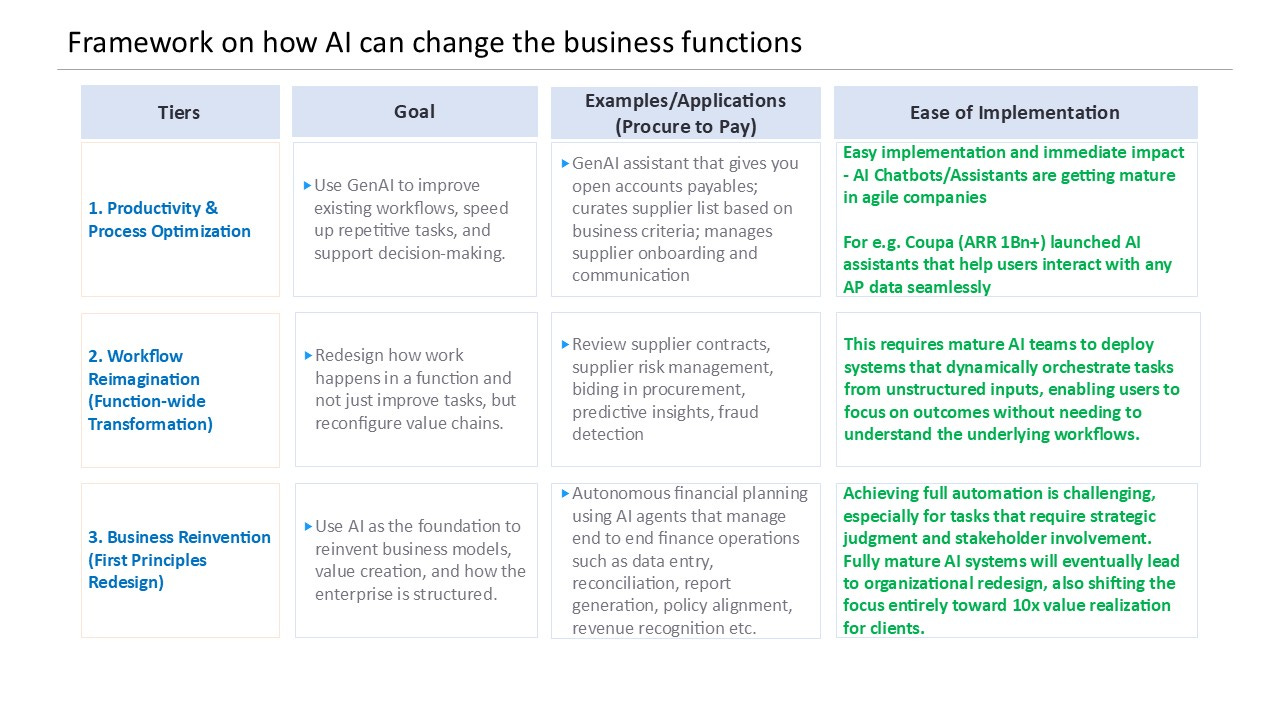

How GenAI could disrupt SaaS and change companies that are using it -

Reimagining Procure-to-Pay Workflow: CFO’s Strategic Advantage

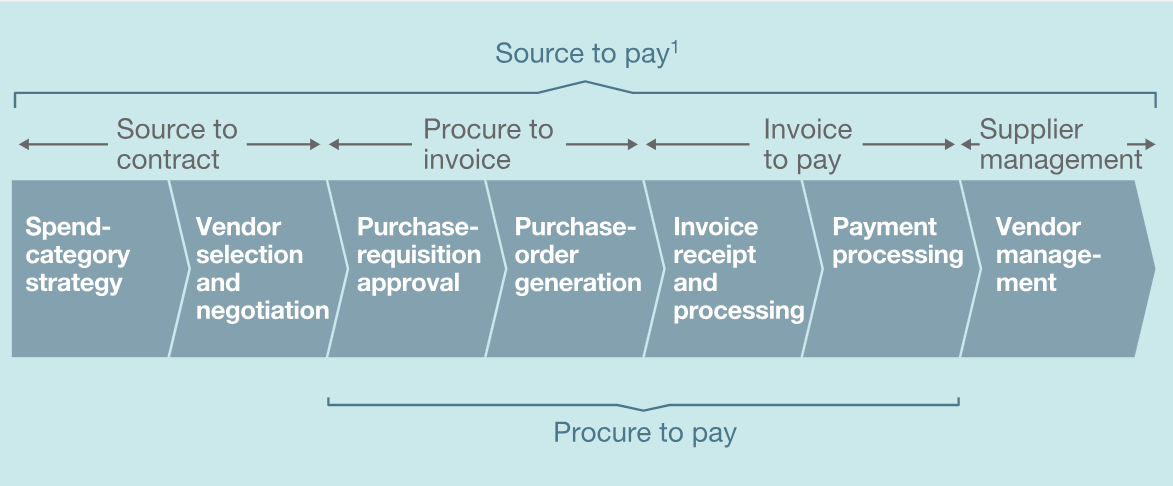

The procure-to-pay (P2P) process represents the end-to-end journey an enterprise undertakes to acquire goods or services through to their payment to a supplier. It also gives visibility into how every dollar is spent by a business. Which in turn support CFO’s priorities on Cost, Control and Compliance what I call as 3Cs of CFO.

Headcount in the Procurement and Accounts Payable function in an organization ranges from single digits to hundreds, depending on the organization’s scale of operations, number of legal entities, and the invoice volume it handles. This invoice count also varies with the industry type, where manufacturing typically has the highest, followed by FMCG, Retail, then Services, and finally tech, which has the least. More invoices mean more headcount required to review, validate, and approve the invoices. As per the Forrester and Basware study, typically an Accounts Payable (AP) clerk handles 40–60 invoices a day, potentially increasing the headcount cost of this function. With maturing AI, it becomes imperative now to enable CFOs with not just basic automation, but one that is intelligent enough for them to make strategic decisions in a competitive environment.

Double Click of Procure-to-pay Process(P2P)

Purchase Requisition, Purchase Order Generation, Invoice Processing, Payment Management tasks after the contract is signed(For this blog only procure to pay process is considered)

Pioneering the E-Procurement Era (Late 1990s - Early 2000s)

Procurement software emerged in the 1980s, primarily as basic modules integrated within larger ERP systems. Companies like SAP and Oracle began incorporating basic functionalities designed to manage procure-to-pay processes within their broader platforms. These early solutions were largely focused on automating the most transactional aspects of procurement, such as generating purchase orders, managing the receipt of goods, and processing invoices.

The late 1990s, marked by the nascent internet boom, witnessed the rise of dedicated e-procurement software systems with more modules and features. This period saw the emergence of key innovators who would shape the future of the market.

First Movers: Ariba, Commerce One, and IBM's Contributions

Among the most prominent pioneers were Ariba, founded in 1996, and Commerce One in 1997. These companies focused on leveraging internet to create specialized procurement solutions.

The rapid success and market penetration of these "pure-play" procurement software firms served as a powerful catalyst, compelling established major business software players like Oracle and SAP to accelerate the development and introduction of their own competitive solutions. For instance, Oracle acquired PeopleSoft in 2004, thereby gaining their nascent PeopleSoft eProcurement application. Similarly, SAP quickly launched an E-procurement offering (EBP), which eventually matured into SAP SRM in 2005.

Early Adopters: Who embraced the technology and why

The initial wave of adopters for e-procurement technology comprised predominantly large, private sector enterprises. Prominent examples include Walmart, Ford, and General Motors. These early adopters realized substantial and tangible benefits, reporting a significant 5-20% reduction in their overall purchasing and acquisition process costs. Such considerable cost savings, especially for organizations with vast procurement volumes, provided a compelling ROI. Beyond the private sector, public entities also began to embrace e-procurement. In Europe, recent mandates on B2G and B2B purchases aiming to modernize EU VAT rules by focus on e-invoicing.

Integrated Ecosystems: Key Systems P2P Connects With

The evolution from proprietary integrations to open integration architectures and the current push for seamless integration across ERPs and applications underscore that interoperability has been a persistent hurdle that has shaped the development trajectory of P2P software. This ongoing demand for robust and flexible integration capabilities continues to drive vendors to invest heavily in APIs, data connectors, and integration platforms, influencing market competition and product roadmaps.

From Foundational to Feature-Rich: From Initial Phase to Cloud to AI

The journey of P2P software can be segmented into distinct phases, each characterized by specific technological drivers and a broadening scope of functionality:

Cloud-First and Best-of-Breed (Late 2000s - 2010s): With advent of cloud new entrants, notably Coupa (founded 2007), emerged with cloud-native P2P solutions. These "best-of-breed" providers often adopted open integration architectures, allowing for flexible connectivity with a wide range of existing back-end systems. The market began a definitive shift towards cloud-based deployments, valued for their scalability and cost-effectiveness.

Comprehensive Spend Management and AI Integration (2010s - 2020s): Current state of the market is heavily influenced by the integration of AI and ML, driving enhanced automation, real-time visibility, predictive analytics, and an improved user experience. Current platforms offer features such as AI-powered invoice data capture and approval routing, AI copilots for intelligent assistance, highly adaptable and configurable workflows, comprehensive audit trails, support for complex purchase orders and line-level matching, integrated card payments, advanced budget management etc.

The global procure-to-pay software market is experiencing significant growth, valued at approximately USD 4Bn in 2024 and projected to reach USD 10Bn by 2033, demonstrating a robust compound annual growth rate (CAGR) of about 11% from 2025 to 2033.

Key Players: The market is a blend of established enterprise software giants and specialized best-of-breed providers. Notable companies include SAP Ariba, Oracle, Coupa, Esker, GEP, Zycus, Tipalti, Airbase (Acquired by Paylocity in 2024), Jaggaer, Basware, Ivalua, Procurify, Precoro, Stampli and HighRadius. Other major players, such as ServiceNow, also offer P2P workflows.

P2P is a fragmented market with a long tail of software providers offering capabilities similar to market leaders, with ARR ranging from $5M to $20M. Most of the value will be generated by reimagining the current workflow.

Since P2P is a transactional workflow, business users will remain highly involved with human-in-the-loop interactions. The underlying AP automation workflow will largely remain the same, even in the AI era. However, the large value will be captured by reimagining the workflow and delivering an enhanced end-user experience.

Companies that have adopted AI in their procurement processes report substantial improvements. For instance, they have seen a 30-40% reduction in invoice processing time and a 25% improvement in compliance rates.

Most of the companies are trying out GenAI, but it still exisits as a series of pilots companies are trying and testing without changing their underlying technology. How it drives business impact will depend on the end user value and how can one remimagine end client value to be 10x.

This Shift Is Already Underway in Finance Operations -

Rillet - Rillet is challenging SAP and Oracle’s legacy ERPs by offering an AI-native financial ERP built from the ground up, enabling features like zero-day close and a “one-person Finance function” that drastically reduce manual work and specialist dependency all with better UX and with implementations without lengthy consulting projects.

Tabs - Tabs automates Accounts Receivable (AR) and Accounts Payable (AP) by using LLMs to extract commercial terms directly from signed contracts, automatically generate billing schedules, compute invoices, and streamline collections and payments, all within a single end-to-end platform. This eliminates the need for manual data entry, reduces reliance on multiple point solutions, which legacy ERP systems like SAP and Oracle typically require users to manage through manual workflows and siloed tools.

Tola - It leverages AI to automate the extraction of key terms from contracts and sales agreements, enabling instant invoice creation, automated reminders, payment collection, and reconciliation all within a unified platform

Aerchain - Aerchain provides AI agents for tasks such as Sourcing, Analytics, Negoation, and Vendor Onboarding. The platform integrates conversational AI for product actions and cash flow insights, helping businesses manage accounts payable with minimal manual intervention.