[4]From Seed to Scale: Crafting a Winning GTM Strategy for SaaS (Part I)

For ARR $0–1Mn and $1–10Mn

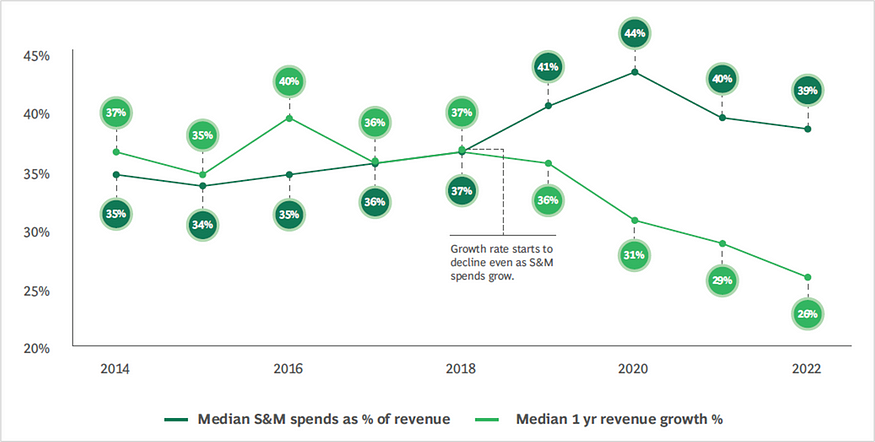

Products in today's environment offer little distinction and are relatively commoditized. The only way to differentiate and grow is by focusing on building network effects through value provided to customers. Over the last two decades, organizations have moved from sales-led growth in the 2000s to product-led in the previous decade to community-led growth. How software is bought and sold is changing significantly, and so is the role of customer-facing teams (marketing, sales, and customer success). Focusing on go-to-market (GTM) becomes ever more critical in this setup. The chart below gives insights on S&M spending vs revenue growth of the SaaS:

People often confuse Go-to-market(GTM) strategies and marketing plans. They generally go hand in hand, but they have some key differences —

GTM strategy: This exhaustive plan guides the user through each step of the product launch process, from R&D, product development to distribution. It covers the steps necessary to achieve revenue milestones for the product development, sales, and marketing teams.

Marketing plan: This is developed on a small subsection of the GTM strategy and outlines a plan for promoting a product to the target audience, including channels, messaging, performance measurement, and more. Marketing plans also include long-term suggestions for increasing brand perception and profitability, which may go beyond a single product.

Types of GTM Strategy:

Primarily Inbound

Primarily Outbound

Mindset/Strategy needed to scale highly effective GTM for ARR $0–1Mn:

Conviction and certainty are not the same. Initial GTM is about experimentation; no founder knows what will work for his product on day 1. This GTM is founder-driven and requires them to speak with many prospective customers to first figure out the ideal customer profile (ICP) for the product. Sometimes, TAM that appears huge may also turn out to be shallow; hence, it is necessary first to figure out the target ICP in the first few months.

Building your initial GTM

In the early days, the GTM strategy for any SaaS startup has to be a founder-led sales engine. After that, depending on the type of product, figure out the best GTM for your product (inbound or outbound) through experiments. Double down on channels that provide the most ROI.

Getting customers to pay — Asking for money for your product is critical and should be done as early as possible. At times, founders delay asking for money during pilots. For larger enterprises, it may be tough to trust an early-stage startup, so that varying pricing structures might be an option. It is essential to be flexible with pricing so that you don't leave any money on the table.

Pitching to your prospects — Best way to explain the value proposition of your product to prospective customers is through numbers linked to ROI. Help customers foresee success in numbers and then demand a price accordingly.

Scaling after a first paying customers —The first sign of growth after a few paying customers is when you have repeat customers. The next sign is when your existing customers are ready to refer you to another set of customers via word of mouth. These are a couple of indications to press the foot on the accelerator and grow in the market.

Optimizing product feedback —According to Niraj, Founder and CEO of Hiver, it is important for founders to know that if customers are satisfied with the product, they won't leave the product because 1 or 2 features are missing. From my learnings working with Niraj as a Chief of Staff, Founders need to strike a balance between features that customers want and the product they want to build. Sometimes, there is a huge difference; sometimes, it's just incremental features, so figure out what works best for you and act accordingly. One way to tackle product feedback from customers is — once in a while, to show your customers a future design prototype of the product without building it; if the feedback is positive, start building.

Founders are involved in the initial product demos; Gaurav, Founder and CEO of SaaS Labs, ran most of the GTM till they had crossed 400+ demos, 100+ customers, and over $30K in MRR ($360K in ARR).

Mindset/Strategy needed to scale highly effective GTM for ARR $1–10Mn:

Nailing Channel Throughput: If your GTM is product-led, then Nailing your inbound reach becomes crucial; hence, many founders focus on creating a pull for their product even before launching their product by putting out content. If your GTM is primarily outbound, focus on hiring the right team of BDRs and tracking their performance, such as number of calls/emails, call response rate, call duration, follow-on calls, scheduled demos, funnel movement, and conversion rates at different stages of the funnel.

Trial and Error: Experiment with different GTM channels to identify what works best for your product. For example, if your organic website traffic is high, then focus on optimizing that traffic. After you start monetizing on the best-suited channel for your product, don't stop experimenting, as you will have backup channels to monetize on, or you may find a different way of targetting your ICPs. Later in your journey, experimenting with affiliates, partnerships, and outbound marketing can be extensively tried. It is important for founders to not try too many GTM experiments simultaneously and keep the number to 2–3 with quality resources leading initiatives.

Brand Building: Invest in product marketing early on and hire a dedicated product marketing person. Branding becomes even more critical after entering into a new ARR milestone. At Hiver, we launched multiple branding initiatives, such as the Customer Success Forum and Video Campaigns, focussing on core USP to increase outreach.

Important Metrics To Track:

For 0–1Mn

Churn Rate: A high customer churn rate, also called logo churn, is a clear indication of not finding product-market fit. If customers are happy, they will not churn overnight because a feature is missing (I will cover this separately in the PMF piece). The churn rate also impacts your MRR and indicates wrong targeting or ICP.

NRR: Measuring customers who make recurring purchases on a consistent schedule is a positive indicator for PMF. Repeat customers spend more money, are easier to upsell, and are cheaper to retain. They also draw in more referrals and are great candidates for beta tests.

For 1–10Mn

Burn Multiple: Net Burn/Net New ARR. Burn multiple is a function of the stage of the startup; early-stage startups have higher burn multiple as they spend to grow. Hiver ensured they kept the burn multiple low, which means they focused on 2–3 GTM channels that worked for them rather than experimenting with many.

Lead Velocity Rate (LVR): M-o-M growth in the number of leads generated by the business. Your LVR percentage indicates your pipeline's efficiency and your company's long-term growth potential.

NPS: A declining NPS score can be an early warning sign of potential churn. NPS surveys often include open-ended questions where customers can provide feedback. This qualitative data can be invaluable in identifying specific issues or features that need attention. Along with NPS, referral contribution to revenue can be measured to see the impact of NPS.

NRR: NRR becomes even more important at this stage because the product is mature well beyond the PMF stage, and product teams keep deploying new features to increase the customers' stickiness and provide high-value features that come in handy for the expansion revenue. NRR of 120% is ideal, but nothing more merrier if it crosses these benchmarks for SaaS business in the ARR range of 1–10Mn.

Sales Rep Ramp: This is the average time new reps take to become fully productive. Combine CRM and HR systems data to normalize AE start dates to time zero and look at the inflection point when reps start hitting full productivity.

Revenue/Employee: It tells how efficiently the business is run. These metric forms the major cost component of any SaaS business.

“The quality of the dollar is way more important than just the quantity of the dollar”. Quality dollars refer to revenue generated from customers who are not just one-time buyers but contribute to your business over an extended period and thus to higher LTV/CAC.

What do you think about initial GTM and scaling? What did I miss?

If you found this piece helpful or interesting, don’t hesitate to share it with your network.