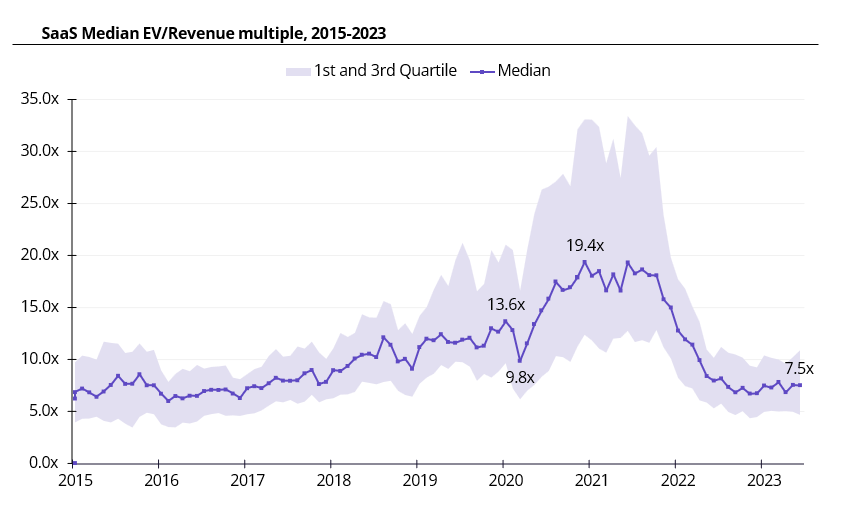

The SaaS valuation multiples reached their peak and plateaued for a period of time in Jan-Oct 2021. One of the highest multiples recorded was Asana, closing at 89.0x Last Twelve Months(LTM) revenue in November 2021. After the Federal Reserve started raising interest rates and growth decelerated, the valuations dropped significantly. By June 2023, multiples reached a plateau at around 7x. EV/Revenue multiples for listed SaaS businesses stagnate at around 7x, with much of the stock price increase coming from larger revenue. Then the next question that comes is how to grow your SaaS business to that level. It is easier said than done, it is easy to draft a growth plan on paper, but it is really hard to implement.

Many SaaS businesses, while scaling, face various roadblocks such as inadequate lead generation, lesser conversion rates, high CAC, lower CLV, increasing competition, and lower customer retention, as articulated in From Seed to Scale: Crafting a GTM Strategy for SaaS (Part I). SaaS makes up the largest share of cloud service (>50%), and its popularity is driving up the new SaaS solutions. In India alone, we have 90+ startups above $10Mn ARR and 12–14 above $100Mn ARR (Source Bain SaaS Report 2022). Scaling to $100Mn and beyond requires a clear vision, exceptional product innovation, a go-to-market strategy that drives the business towards market leadership and a great team to make it all happen. When you are starting a SaaS company from India, it is crucial to gauge competition from outside, as most of India’s top SaaS businesses get >70% of revenue from the USA.

Factors that affect the growth post $10Mn ARR-

1. Crucial Role of Product-Led Growth to Move Up Market

Product-Led or Sales-Led GTM: Product-led firms in the SaaS ecosystem usually begin their growth journey by focusing on small and medium-sized enterprises (SMBs). Product-Led Growth(PLG) provides a first point of access into high Average Contract Value (ACV) opportunities. It acts as a competitive advantage in securing enterprise-level demand, making it the fundamental layer for scaling. PLG enables inbound growth motion, and when teams from larger enterprises come inbound, they are handed off to mid-market sales teams. Now, in terms of expansion, the primary GTM motion for both these customer segments is different, and there’s no natural cross-sell motion. This transition is often interchangeable when you go up-market; your GTM becomes more sales-led than product-led as the sales team tries to crack bigger deals with ACV >$100K.

Some key changes in the primary GTM motion during this transition:

a)Sales Approach changes from Self-service to Sales-assisted: In the SMB space, SaaS companies often rely on self-service models where customers can sign up and start using the product with minimal human interaction. As they move up market, a more sales-assisted approach becomes necessary, involving direct sales teams to engage with larger customers, understand their needs, and guide them through the purchasing process.

b)Customization and Complexity: Enterprise customers typically require more customization in their workflows. SaaS companies must adapt their products and services to accommodate these needs, which may differ significantly from the standardized offerings provided to SMBs.

c)Marketing Strategy — Content, Thought Leadership, and Events: While SMB-focused SaaS companies may emphasize ease of use and pricing in their marketing, those targeting larger enterprises need to invest more in thought leadership and content that demonstrates deep industry expertise. Enterprises often seek solutions that align with their strategic goals and require a more refined understanding of their challenges. Invest in the events to increase word of mouth. SEO to get your product in front of eyeballs goes without saying.

d)Longer Sales Cycles and Data Compliance: Enterprise deals usually involve longer sales cycles and more complex contract negotiations. This often happens because of security and compliance. This requires SaaS companies to invest in training their sales team for a more extended decision-making process and data privacy/security compliances according to the law of the land but major ones such as ISO, SOC2, and GDPR.

e)Integration and Scalability: Often, enterprise customers want solutions that seamlessly integrate with their existing tech stack. SaaS companies must emphasize their products’ integration capabilities and scalability.

f)Customer Success and Support: Larger enterprises often require dedicated customer success teams to ensure successful onboarding, implementation, and ongoing support. These ask for continuous headcount planning in customer-facing teams.

2. Channel Expansion:

a)Increasing Distribution Channels: By distribution channel, Online marketplaces such as Salesforce AppExchange, and Shopify App Store are becoming increasingly popular. Freshworks, when it went for IPO, added 50+ new channel partners globally, as well as a further extension of Independent Software Vendors(ISV) partnerships.

b)Partner Networks: Partner networks, such as resellers, system integrators, or consultants, can be an effective way for SaaS companies to expand their reach and generate new business.

3. Inorganic Expansion:

a)Acquire platforms where your audiences like to hang out: Today, companies are either focusing on building a community from day zero organically or investing in them. Stripe acquiring Indie Hackers, Angellist acquiring Product Hunt, Zapier acquiring Makerpad, and Pendo acquiring Mind the Product are just a few examples that highlight this shift.

b)Acquihire(Acquisition + Hire): SaaS companies continuously need to hire the right talent. Many bigger SaaS companies have gone for Acquihires as it offers multiple benefits, such as access to specialized skills or expertise, more cost-effective than traditional hiring or training programs. Acquihires can be more effective in maintaining cultural alignment between the acquiring and target companies. Since the focus is on talent, the integration process may be smoother compared to traditional mergers, where integrating entire organizations can pose cultural challenges.

c)Diversification into adjacent business models: To enter into adjacent business, the quickest way is acquisition. Finding the right target and post-merger integration becomes crucial to realize the value out of that M&A. For example, BrowserStack acquired Percy to enter into automated visual testing for applications.

4. Building Right Leadership Team:

Hiring external leadership who have scaling experience from the past or bringing in board members with expertise and experience for strategic decision-making. This is particularly valuable during periods of rapid growth when the challenges and decisions facing the company become more complex compared to the early stages when your focus is on PMF and early traction. For example, Freshworks added two new board members when they went for IPO— Zach Nelson, former CEO of NetSuite, and Jennifer Taylor, CPO of Cloudflare. BrowserStack hired a senior leader in the team, Anand Subbaraman, former Oracle VP of Products.

Most SaaS companies, at some point in their lifetime, try to move up market. Slack, Salesforce, HubSpot, Shopify, and Asana have successfully scaled to this level, often by focusing on ACV >$100K.

Financial and Operating Performance Metrics to track:

ARR and its Growth Rate: ARR growth rate is a signal of whether or not an individual company has a product, sales efficiency and market leadership to become a leading company. Scale wins in cloud economics; the larger you are and the more revenue you have, the more defensible your business. Market-leading ARR in your category creates a virtuous cycle with pricing power and talent that reinforces a company’s lead. It is the main metric used to determine the valuations of SaaS companies. Investors also give market-leading companies premium valuations, which lower their costs of capital which help them expand their TAM and dominate the market.

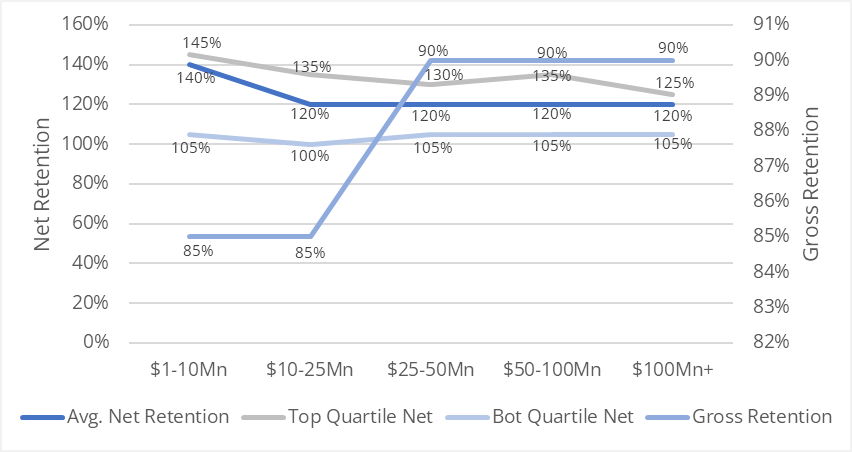

2. Net Retention Rate (NRR): Net new customers obviously add to the ARR growth, but just as important to the health of the SaaS business is the retention and expansion of existing customers. NRR is a key component of ARR growth, and it accounts for the upsells and expansion revenue. According to Bessemer, for early-stage companies ($1–10Mn ARR) average NRR is 140% decreasing to an average of 120% for companies at $10Mn ARR or more. Therefore to be a successful SaaS company, you generally need a model in which your customers increase spend with you by 20%. Gross retention in SaaS companies averages above 85% across the lifetime of the SaaS business. When SaaS businesses retain existing customers, they don't need to deploy valuable sales and marketing(S&M) dollars to replenish lost customers; they can use that expense to generate net new revenue and more net growth.

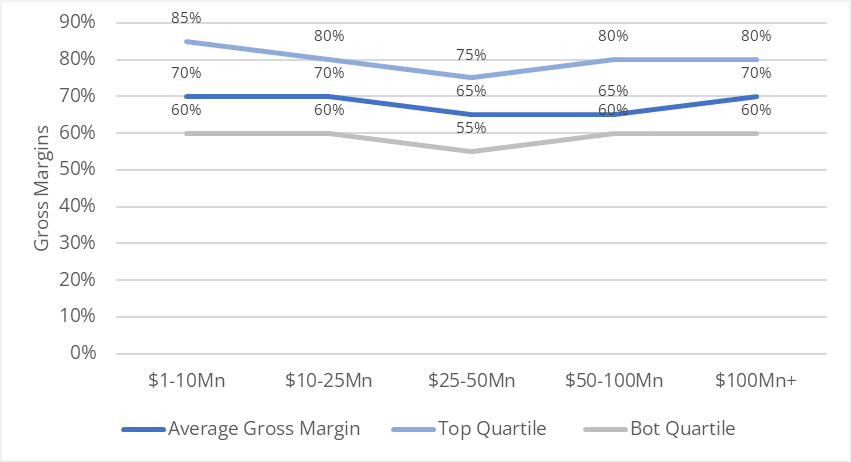

3. Gross Margins: This measures how effective the company is in delivering its software to its customers, and it captures the variable costs inclusive of customer success, support and cloud hosting costs. Regardless of the stage of the company average gross margin of the SaaS company is 65–70%. The higher the gross margin, the more the SaaS company can invest in operating expenses rather than in product delivery, in which the incremental cost of delivery of a product should be very low. Gross margin varies based on customer segment as CAC for different customer segments differ.

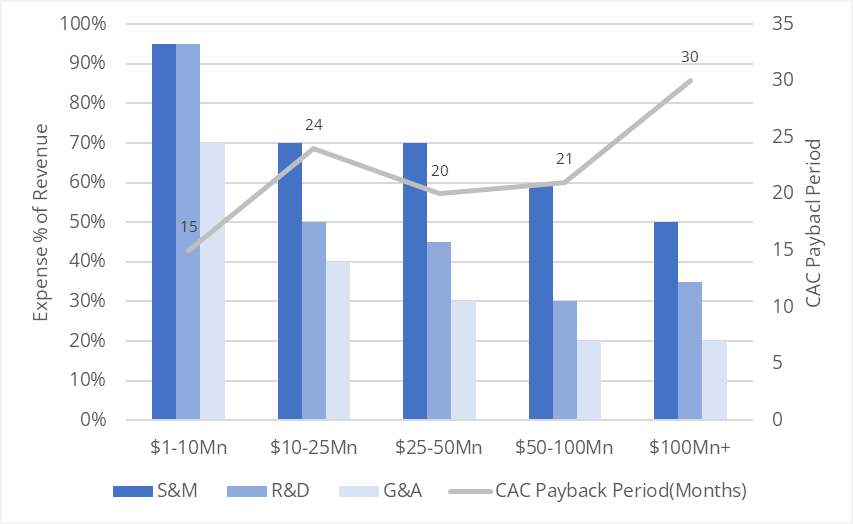

4. Sales Efficiency is the Capital Efficiency: From $1–10Mn ARR average, SaaS company spend 95% of its revenue on the S&M, and it decreased to 50% of revenue by $100Mn of ARR or more. Given how high SaaS companies require S&M spending to be across their lifetimes, we should use the CAC Payback Period as another metric to measure the efficiency of that spend. CAC Payback is the rate at which the cost to acquire a customer is repaid by that customer. CAC Payback is 15 Months in $1–10Mn ARR increasing to 30 months at $100Mn or more as marginal customer becomes more expensive to acquire. S&M expenses scale more linearly with revenue than other operating expenses. In contrast, R&D expense which capture product and engineering, tends to be high initially at 95% of revenue from $1–10Mn ARR and average 35% by $100Mn ARR. G&A expenses initially are 70% of revenue and decrease to 20% by $100Mn.

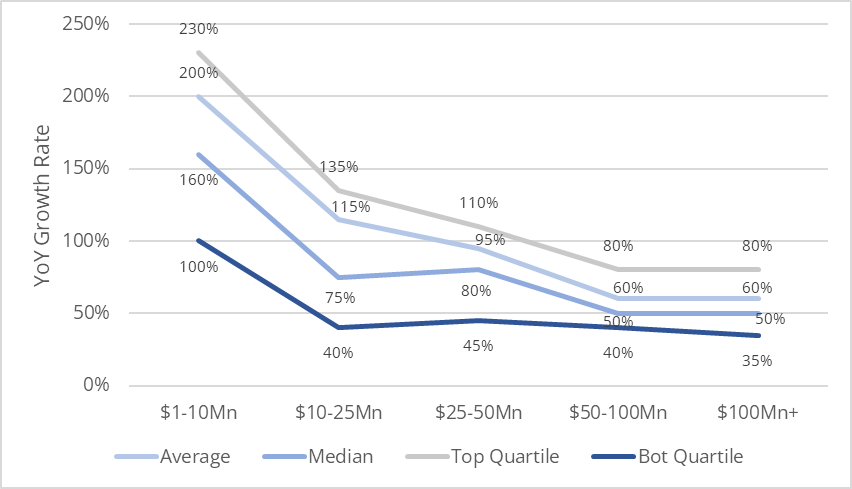

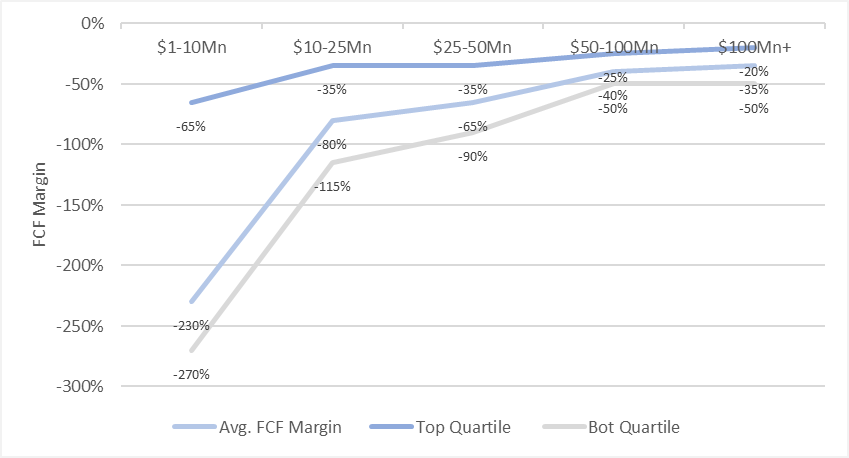

5. Cash Flow: Balance Growth with Profitability; like any business, SaaS business also has deep negative cash flow in the early stage. It, on average, ranges from -230% in $1–10Mn ARR to -35% by the time it crosses $100Mn ARR. Essentially SaaS businesses get leveraged from their operating expenses and revenue growth. The goal of any company is to generate cash, and burn multiple should be kept in check. SaaS business might also check Burn Multiple = Net Burn/Net New ARR; investors like to have this multiple lower as it shows the sales efficiency of the SaaS business.

6. Efficiency Score: FCF Margin of Revenue by ARR Scale, FCF margin of ARR + Y-o-Y ARR growth rate — This metric helps to show the trade-offs between growth and profitability, but it applies only to growth-stage companies. The “Rule of 40-Magic Number” is often quoted in that companies should have efficiency scores of 40%+. Another Effieicny Score metric is Cash Conversion Score = ARR/(Total capital invested — Cash); this is effectively the return on investment of each dollar ever invested into a company.

Data Sources: Tracxn, Pitchbook, S&P Capital IQ, Bessmer Venture Partners Portfolio Analysis.

What do you think about initial SaaS Growth? Let me know in the comments.

If you found this piece helpful or interesting, don’t hesitate to share it with your network.